A Simple Guide on How to Bridge to Solana in Seconds

Table of Contents

- Key Takeaways

- Why Bridge to Solana

- What is a Solana bridge?

- Common Challenges with Solana Bridges

- What You Need Before Bridging to Solana

- Step-by-Step Guide: Bridging to Solana with deBridge

- For Developers: Add Solana Bridging to Your App

- Conclusion

- Frequently Asked Questions (FAQs)

- Related Resources

As users move assets across chains, they increasingly choose Solana for its lightning-fast transactions, low fees, and instant finality. All of these are directly advantageous for active traders, DeFi users, and builders seeking scalable onchain experiences. Bridging to Solana unlocks access to Solana-native dApps, deep liquidity, and high-performance trading opportunities that are difficult to match on slower, higher-cost networks.

Traditional cross-chain bridges often introduce friction through long settlement times, complex flows, and security risks tied to wrapped assets or centralized intermediaries. deBridge addresses these pain points by enabling fast, secure, and decentralized asset transfers, allowing users to move liquidity to Solana efficiently.

In this guide, we’ll explore why you should bridge to Solana, common challenges with traditional bridges, what you need before bridging, and how developers can integrate deBridge.

Key Takeaways

- Solana offers high-speed, low-cost transactions, making it ideal for DeFi users, traders, and anyone seeking fast execution and affordable fees.

- A Solana bridge enables decentralized cross-chain transfers, allowing users to move assets seamlessly from EVM-compatible networks to Solana.

- deBridge eliminates common bridging risks such as pooled liquidity, wrapped tokens, and manual wallet setup through its 0-TVL architecture and native asset transfers.

Why Bridge to Solana

Connecting to Solana provides numerous benefits and an ecosystem of dApps tailored to various needs. Here are some key advantages of Solana:

- Access to Solana’s Ecosystem: Solana is home to popular DeFi apps like Jupiter, Kamino, Pump Fun, and more. By bridging into Solana, you get the key to this fastest-growing ecosystem.

- Fast Throughput: Solana is built for speed and throughput, making it ideal for traders, power DeFi users, arbitrageurs, or onchain gamers. For example, real-time oracle systems choose Solana for its rapid block times.

- Lower Fees: Compared to congested EVM chains where gas can spike, bridging assets to Solana offers a lower-fee environment for swaps, transfers, and interacting with dApps. Now you can also trade tokenized stocks on Solana.

- New Project Launches: Due to Solana's affordable and fast infrastructure, many new projects opt to launch on Solana. This means that bridging into Solana gives you a front-row seat to new tokens, airdrops, and emerging DeFi protocols.

Common Use Cases

- Trading Solana-native assets on Jupiter, Raydium, and other Solana DEXs

- Participating in new token launches and airdrops within the Solana ecosystem

- Minting, buying, or trading NFTs on Solana-based marketplaces

- Accessing DeFi protocols for swapping, staking, lending, or yield farming

- Building or interacting with Solana dApps that require assets bridged from other chains

What is a Solana bridge?

A Solana bridge is a decentralized protocol that connects Solana with other blockchains, enabling users to transfer tokens and assets across networks without relying on centralized exchanges. By using smart contracts and cryptographic validation, it facilitates secure, trustless cross-chain swaps. Solana bridges improve interoperability, unify liquidity across chains, and support decentralized ecosystem growth.

Common Challenges with Solana Bridges

While bridging is powerful, users often face several issues when bridging to Solana. Let’s take a look at them:

- Wrapped Tokens: Many bridges don’t deliver native SPL tokens; instead, users receive “wrapped” or synthetic versions.

- Pooled Liquidity Risks: Centralized liquidity pools can be hacked, drained, or mismanaged.

- Limited Wallet Support: Some bridges only support a handful of wallets or token standards.

- Settlement Delays: Transactions may take minutes or hours due to liquidity routing or manual validation.

- CEX Reliance: Many users still rely on centralized exchanges to move stablecoins between chains, resulting in withdrawal limits and KYC delays.

There are many things to consider when looking for the best Solana bridge. Our guide "Best Solana Bridges in 2025" will help you pick the right bridge.

How deBridge Solves Them

deBridge removes the bottlenecks and risks of liquidity pools by enabling value and information to flow instantly across the DeFiverse with deep liquidity and guaranteed rates.

- Real-time Bridging: Transfers settle in seconds with instant finality. No waiting, no stuck transactions.

- Native Assets Only: SOL in, native ETH out. No wrapped tokens.

- 0-TVL Architecture: No user funds are stored in smart contracts or liquidity pools, eliminating honeypot risk.

- Universal Wallet Support: Compatible with EVM wallets like MetaMask, WalletConnect, Coinbase Wallet, Trust Wallet, and others. Solana wallets supported include Phantom, Bitget Wallet, Solflare, and more.

Comparison Table

What You Need Before Bridging to Solana

Before you begin, ensure your setup meets the basic requirements for bridging to the Solana blockchain. Here is a checklist to help you confirm everything is in place:

- Supported Solana wallet: Install a Solana-compatible wallet (e.g., Phantom or Solflare).

- Gas on the source chain: Hold enough gas tokens on your origin network (such as ETH, BNB, or TRX) to cover bridging fees.

- SOL for transaction fees: Keep a small amount of $SOL in your wallet to pay for gas fees on the Solana network.

Step-by-Step Guide: Bridging to Solana with deBridge

deBridge offers a quick bridging solution to transfer assets between Ethereum and Solana. Let's see how:

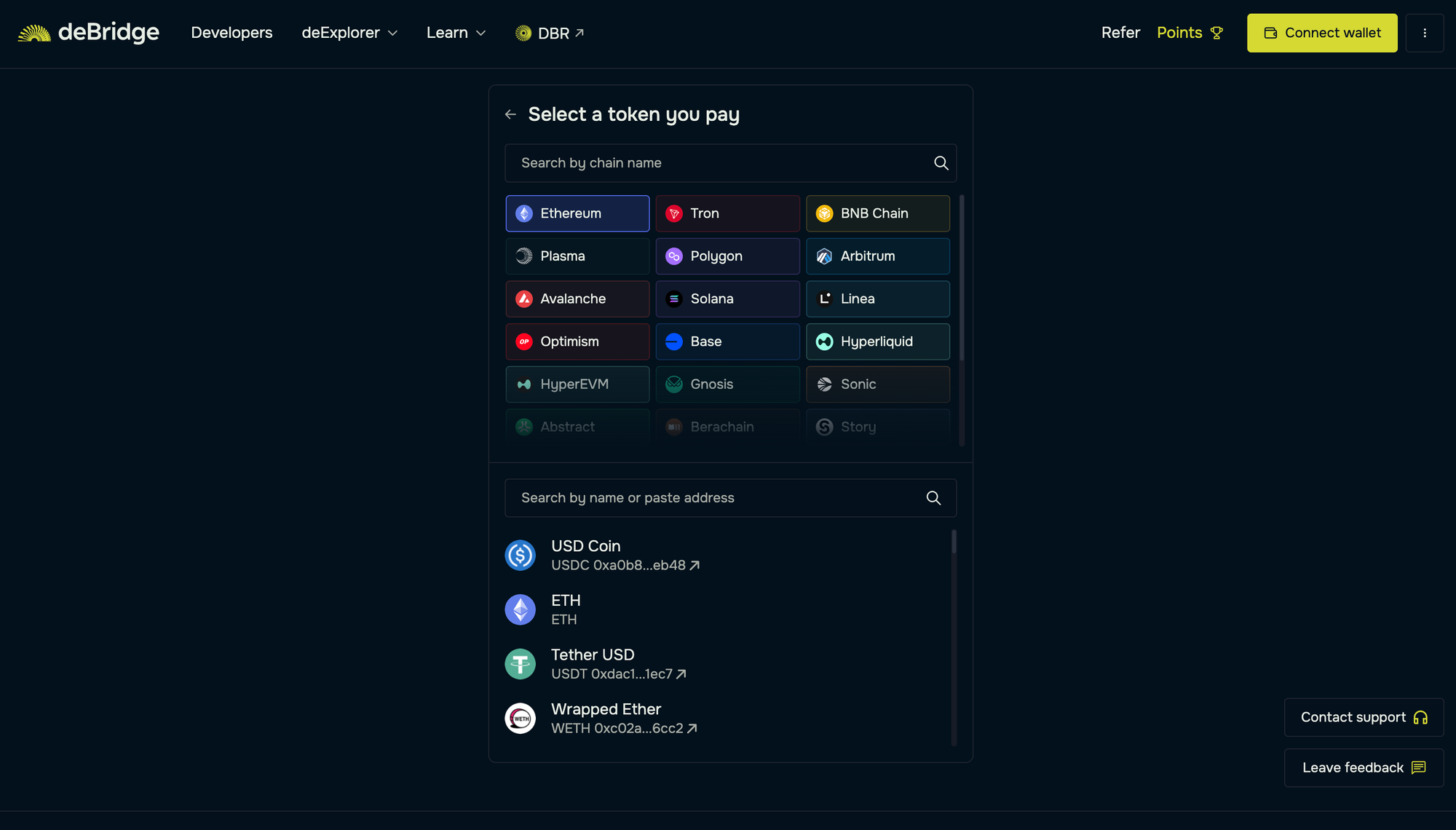

- Visit app.debridge.com/

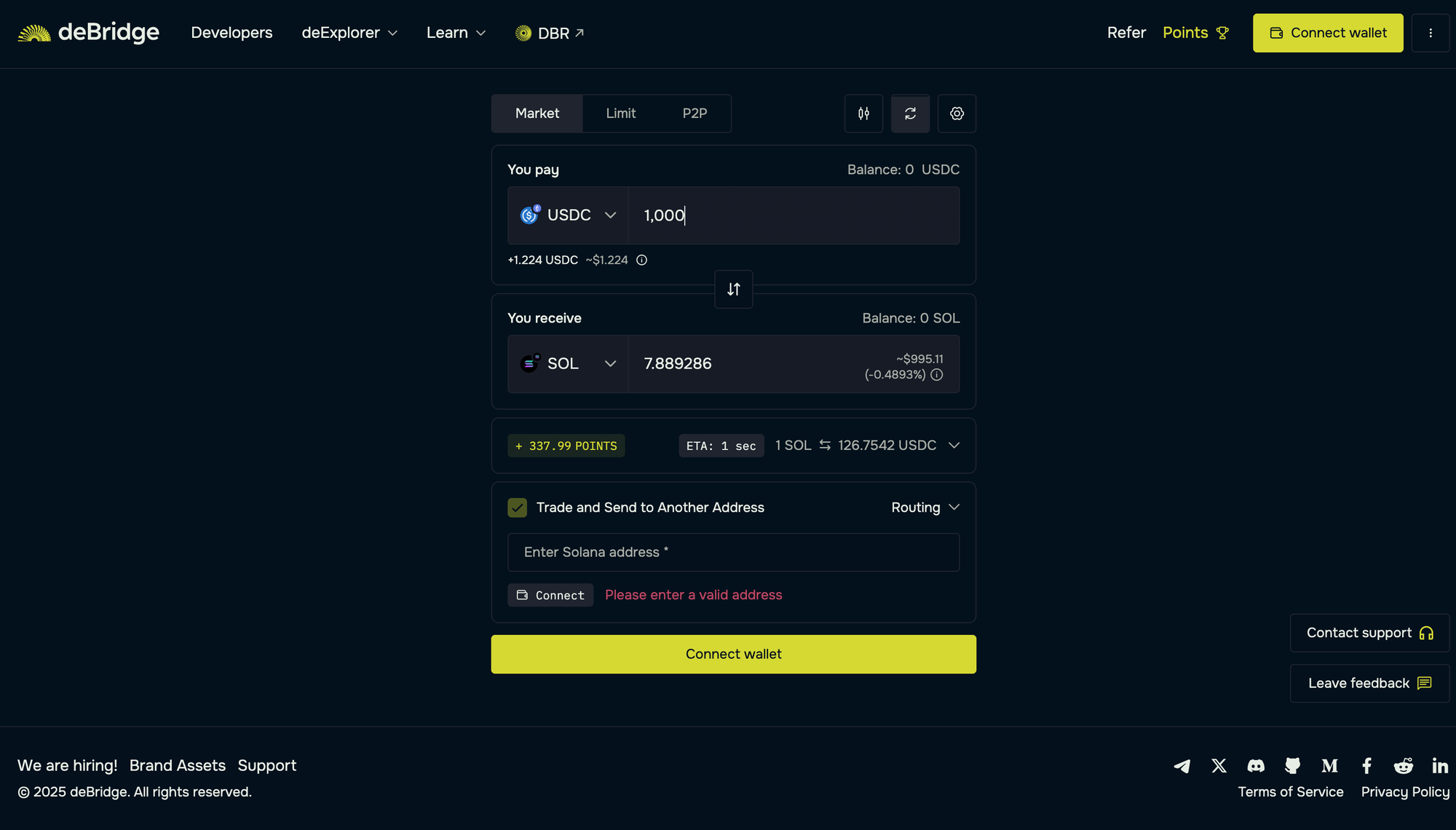

- Select the source chain and asset you’d like to bridge. Here, we will select Ethereum as the source chain and USDC as the asset.

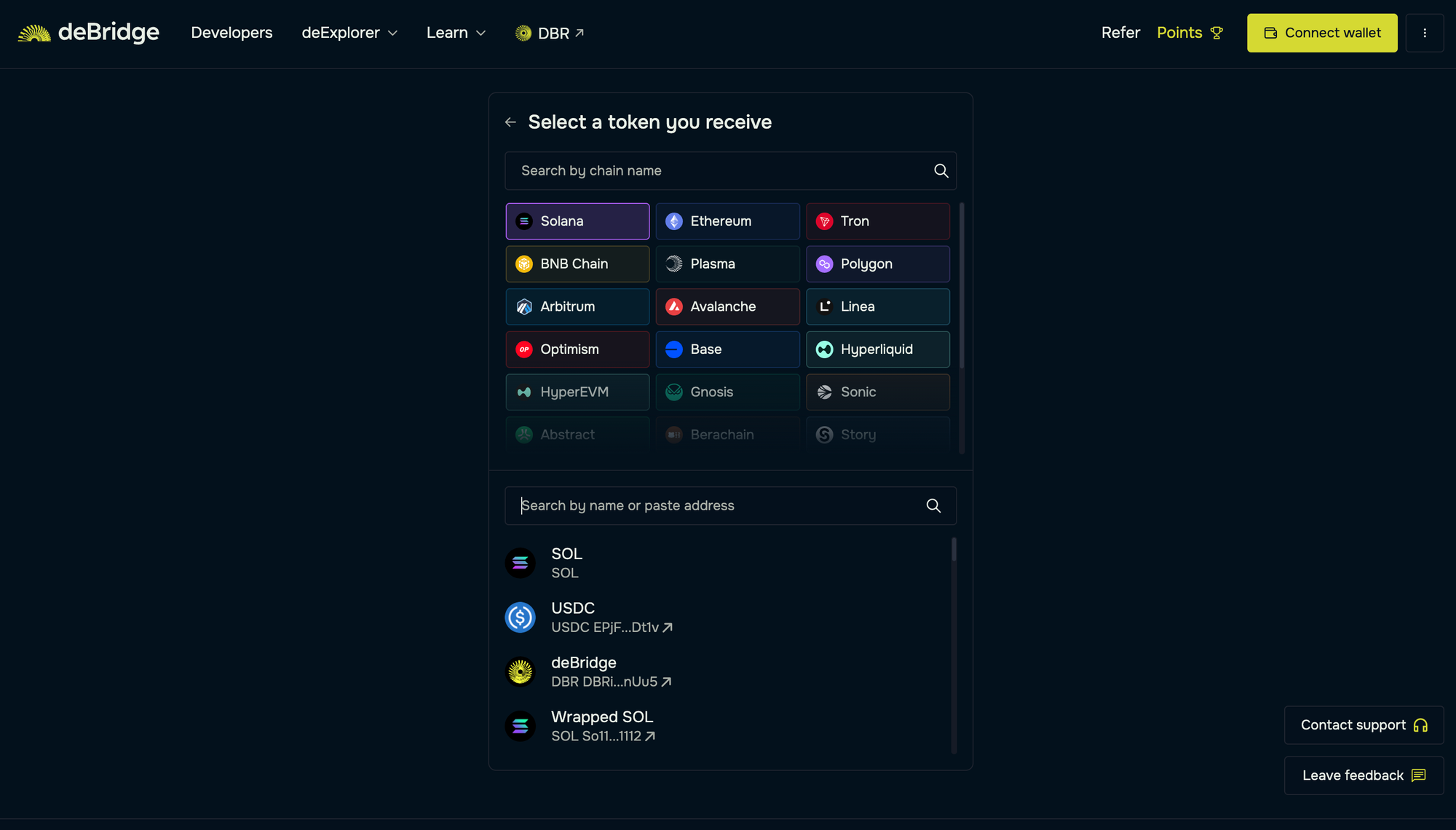

- Next, select the destination chain and asset you’d like to receive. Here, we will choose Solana and SOL as the asset on the target chain.

- Connect your EVM wallet as the source and Solana wallet as the destination.

- Enter the USDC quantity and review the transaction details.

- Confirm trade and sign the ensuing transactions to receive native USDC in your Solana account.

The "Order Fulfilled" pop-up will appear on your bridging screen in 1-2 seconds, indicating that the process is complete and bridged assets have been received in your Solana wallet.

Pro Tips

- Keep a track of Ethereum fees on Etherscan to save on potential gas costs during bridging.

- Ensure you have sufficient $SOL in your destination chain (Solana) for future transactions.

Technical users can also inspect the transaction(s) on the Solana explorer.

For Developers: Add Solana Bridging to Your App

Building cross-chain functionality into your dApp is simple and easy. With deBridge, developers can enable USDC ↔ SOL bridging in just a few lines of code using our developer APIs.

Whether you're building a DEX, NFT platform, onchain game, or wallet, integrating deBridge opens a seamless way to onboard users from Ethereum, BNB Chain, Base, and more. Now, with an added functionality, you can explore how to fetch real-time DeFi data with deBridge Hooks.

Why Integrate deBridge

Developers can embed cross-chain USDC-to-SOL swaps directly into their apps using deBridge’s widget or API.

- One-Line Integration: Add cross-chain functionality without rewriting your stack.

- Easy-to-use API: Access bridging routes and quotes in real-time.

- Instant Finality: Every transaction settles natively in real-time.

- Affiliate Revenue Model: Earn fees from every trade executed through the integration.

- Multi-Chain Support: Integrate deBridge once and support 25+ chains at the same time.

Conclusion

Bridging to Solana opens the door to one of the fastest, low-cost, and vibrant ecosystems in crypto. Whether you’re chasing new DeFi opportunities or exploring the latest token launches, Solana delivers speed, scalability, and low fees that few networks can match.

With deBridge, you can move assets to Solana in real-time with no pooled liquidity, no wrapped token risks, and no manual setup.